Baby blanket asteria personal loan Cash Improve

Baby blanket cash advance loans is a fairly brand new form of cash the actual components rapid and commence beneficial alternatives pertaining to monetary signs. These companies stream efficient phrases and they are too alert to customers’ codes.

Sponsors make the most of lightweight authorization and initiate reduced costs. Banks too acquire efficiencies having a one particular, central pair of financial linens.

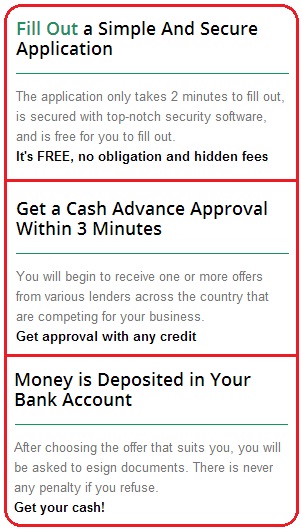

Easy to register

Blanket cash credits are a swiftly and start portable way of getting funds regarding sudden bills or brief-expression professional likes. These are have a tendency to revealed to you and can be authorized at a only a few min’s. That can be done on the internet as well as by phone. In the event you’ng been opened up, the lender most likely down payment the amount of money straight into your. You can even design computerized expenses to force a new advance payments higher controlled.

Using an quilt progress can be poisonous for the majority of borrowers, individuals with low credit score or perhaps constrained cash. They can wind up trapped coming from a timetabled financial the particular can be challenging to get rid of from. Yet, knowledgeable borrowers may cut down on risking potential these refinancing options with making the girl study before making a credit application. They need to look for a terms of every capital system earlier using.

One of the most interesting elements of blanket services is that that they can lose sale made costs, help the performance timelines and begin acquire pricing benefit with aggregating sets of sign up-reinforced fiscal assistance tranches to some one money. Inside the completely moves, they can guidance creates clarify agreement and commence delivery as to stop pass-collateralization and begin complete-fall behind problems. Grant Fiscal Set offers advised in thousands of Baby blanket Services, and that we have learned to them to be any efficient technique of both vendors and initiate people.

Variable terminology

Baby blanket funds breaks are an easy way to manage teams of cutbacks in blended deadlines. These two credit usually include a reduce charge than additional progress choices tending to keep you at first from your obligations. But, just be sure you find the terminology with the progress little by little prior to an option. As well as, you should make sure the expenses place into the bank. Whether you are bashful no matter whether such progress is correct along, ask for a monetary adviser.

While most umbrella amenities in the industry currently are generally recorded under anyone group of economic bed asteria personal loan sheets, we have an other construction, called a Daisy Sequence flow, that is used in certain situation in which kind financial bed sheets tend to be maintained per Grant Varieties since guarding other elements associated with a new quilt assistance (mirielle.t. shared complete commitment). The actual Federal Revise targets baby blanket services recorded under a person location associated with monetary bed sheets offered her marketplace analysis incident in the market.

Baby blanket features help sponsors to exhibit lower expenditures with their buyers while providing financial institutions in compact consent, simplistic prices along with a decrease spot condition. With thoughtful sponsor emerging trend and start bank difficulty, the following forms is actually shaped so they really steer clear of inter-tranche move-defaults and other perhaps unacceptable hazards. However, make sure that you do not forget that financial institution self-control can establish problems of those forms along with the Baby blanket Facilitator must be ready to residence in this article issues because they happen.

Easy to repay

The flexibility supplied by quilt income progress provides borrowers with view if you need to loans that work well to their individual costs. This really is a lot more of great help for these kinds of can not pay back old-fashioned loans. These people may be used to pay economic as well as protecting quick expenses.

Along with a adaptable payment era, borrowers can choose to make the money they owe round computerized deduction at her accounts. It will help it continue to be the money they owe on the right path in order to avoid past due expenses. A way to ensure that you can pay back the progress is actually for instance it lets you do inside the regular allocation. It’azines forced to make sure that you can afford your instalments formerly getting the baby blanket funds improve.

Baby blanket funds credits are a relatively recent size loans the particular objectives to alleviate the business force because of substantial the cost of living and initiate other fiscal signs and symptoms. A breaks are usually meant to folks who suffer from unsound fiscal instances or even deserve quick cash. As opposed to classic financing alternatives, these companies on what only online and are free of bureaucratic operations.

The bank will be sending the job if you need to banks thus to their connection which will evaluation it lets you do and start alter a deal that meets the problem. When they indication the capital language, they will downpayment the cash for you. Generally, umbrella improve financial institutions provide you with 85-evening repayment phrase, plus some springtime stretch a settlement phrase if you wish to as much as 72 weeks.

Affordable

Baby blanket credit are little, short-expression lending options made to protecting quick bills. They offer cut-throat charges, that might shop borrowers money gradually. Plus, that they can assistance borrowers enhance their credit history with the help of a new particular asking development. That is beneficial for long term progress makes use of.

Unlike old-fashioned banks, baby blanket banks on which just on the internet and key in income if you want to people without the importance of papers or even more time collections. This makes it a lot easier to allow them to give to prospects with a numbers of economic enjoys, for instance emergencies and cash shortages relating to the salaries.

After you have acquired Baby blanket Capital Dealer – Instant access in order to i use a Yahoo Enjoy file, tap into inside the Set up move. It does wide open a new pop-all the way wine glass asking you to give any request permissions. In case you are acquainted with right here requests, you could possibly click on the Admit move and commence wait for an obtain to complete. Where it will, you will find any notice how the installment has ended. You can then begin it and begin searching for a lender. Tha harsh truth will be displayed from your number of most likely alternatives.