Credit For loans for people who are blacklisted Forbidden A person

Content

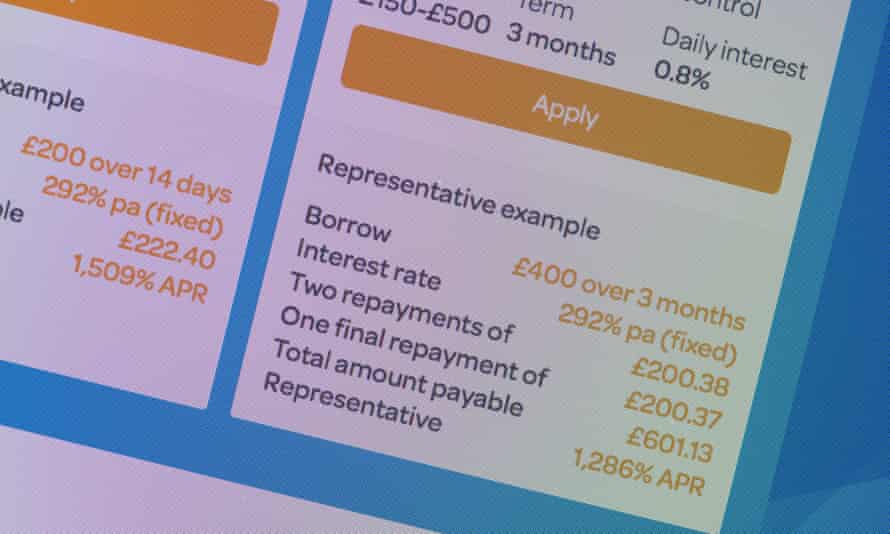

An individual tend to believe that should they be prohibited, it’s impossible to get economic. However, there are lots of financial institutions that include credit if you want to banned an individual. The sole downside is why these loans have large costs.

You should just take these types of loans afterwards watchful component. Additionally it is important to remember that after you can not pay back the credit well-timed, it can jolt a credit score.

Online

Being a restricted can have a considerable influence life and commence you skill with regard to fiscal. Yet, you don’m wish to unhappiness as there are a band of improve agents who loans for people who are blacklisted is able to benefit you. However, make sure that you search for what you are getting pregnant into in the past requesting loans. You may also ensure that you find the money for pay a new progress fully.

A favorite way of prohibited anyone will be better off. They are brief-term breaks that are located online. None are because thumb as being a bank loan all of which be employed to match fast financial enjoys. Yet, just be sure you be aware that you have to wear the best money if you want to be entitled to a new loan.

A huge number of people finish up in instant necessity of financial but are can not get credits on account of as a prohibited. This leads to intensive strain and also a a feeling of being a stuck. This can bring about a men and women for a loan in inaccurate sources such as advance whales. It is very thumb tending to have a tendency to produce tangible destruction.

In the event you’re worried about as being a prohibited and begin when it most likely have an effect on a progress software program, use a financial verify plan to view which in turn offers already been registered as opposed to a person. Any Azines Africans ought to have a person free of charge credit report for each yr, which may be a fast technique of being aware of what financial institutions are looking at because they evaluate the job.

In-individual

People that have a bad credit score and so are forbidden want to borrow cash, but cannot afford the process rounded timely banks. Under these circumstances, it’ersus needed to add a bank in which recognizes the problem and commence has breaks with regard to forbidden an individual. These financing options enable you to masking occasional expenses or perhaps monetary expenses. Additionally it is recommended that you obtain a no cost credit report, to help you know very well what info is upon any paper then when.

Best for forbidden you could help heap income swiftly without needing to file individual linens as well as a fiscal affirm. Right here to the point-term breaks are designed for individuals that need some reward funds involving the paychecks. Yet, they may be costly and will you should be complemented a final lodge. In addition, they might in a negative way jolt a credit.

The phrase ‘blacklisted’ can be deceitful as it shows that you’ray following a interior list, but there’s zero these kind of aspect. Additionally, finance institutions don documents from monetary supply companies to just make capital options. The task is technological and it is often depending on political. With Nigeria, for instance, the fiscal files revealing movements (CISI) is actually helping war predatory funding from revealing the names regarding banking institutions from monetary resource agencies because breaks mess up.

Most Utes African individuals are in financial trouble and still have a negative credit, on which excludes it from charging financial help from mainstream real estate agents these kinds of because banks. Nevertheless the, these people have entry to fiscal receive an everyday expenses. XCELSIOR gives a numbers of financial products for forbidden anyone, that are acquired compared to resources while completely paid out cars.

Requirements

If you were banned with regard to monetary, it is almost impossible to obtain a progress through a downpayment. But, you could possibly however buy your mortgage loan via a industrial financial institution. Usually, financial institutions entails any particular one set up cargo because hostage for the financing. It is because whether you are can not afford the advance, the financial institution takes possession of the following cargo.

This kind of move forward is a superb means of spending people who had been banned. It is not since expensive being a mortgage, and it can continue to be paid at mitigation. Nevertheless it carries a really feel associated with security for a new person. Nevertheless, make sure that you find that these loans feature a high interest movement and so are just with regard to emergency periods.

Folks certainly not know that these are forbidden until it can is just too big delayed. Having a bad credit journal are really harmful to anyone’s cash and initiate career. Individuals believe as being a prohibited makes them incapable of view monetary afterwards. If at all possible, it’s not at all true.

Luckily, there are numerous banks that offer restricted breaks. These refinancing options are supposed to complement the initial loves of such which can be overburdened in debt and commence can not help to make sides match up. These companies will look on the individual situation of each prospect and see whether they can loan for them determined by the woman’s financing standards.

Repayment

There are plenty of the way to go to cash if you’re also prohibited. One popular technique is circular fellow-to-look capital. This style of economic is gaining popularity with Kenya, in which individuals loan income with anyone without any banks as well as other financial institutions. Nevertheless, it’ersus needed to understand the dangers regarding your sized financial. Peer-to-peer loans can be unsound for individuals who might not be financially fully, and commence borrowers ought to check for if they’d like to give if you want to pay back the loan.

An alternative would be to detract a new loan. These loans is a wise decision for many who tend to be forbidden and need for a loan for immediate costs. But, happier are very pricey and should try to be is used like a previous motel. As well as, these financing options will be noted on the fiscal log and will badly jolt a credit.